For many online sellers, eBay is an excellent platform to build a profitable business. eBay offers many opportunities and benefits, including an easy-to-use listing process, a large customer base, and useful tools. However, when it comes to handling taxes, the process can become somehow complex. eBay has introduced several features to simplify sales tax collection, but sellers need to stay informed about these changes.

In this article, we will cover:

- Overview of Taxes on eBay

- How eBay Makes Sales Tax Collection Easy for Sellers

- Why Sellers Should Be Concerned About eBay Sales Tax

- How Sellers Should Deal with Sales Tax

- How to Setup a Tax Table on eBay

- How eBay Handles Sales Tax on Personal Items

- Drawbacks of eBay Sales Tax

Overview of Taxes on eBay

As an eBay seller, you should know the tax-related responsibilities you should be concerned about. Here’s a breakdown of the key tax considerations for eBay sellers:

Income Tax

Any profit you make from your eBay business is subject to income tax at the end of the year. This tax is based on the total profit you have earned throughout the year. It’s important to keep accurate records of all your earnings and expenses to ensure you report your income correctly.

eBay Fees and VAT

eBay applies certain fees for the services they provide, which can include taxes or VAT. These fees are collected as part of eBay’s overall service charges.

Customs Duties and Additional Taxes

For international transactions, buyers may be responsible for additional taxes or customs duties based on their local laws. If this scenario arises, sellers should inform the buyers of their potential extra costs with cross-border purchases to ensure understanding.

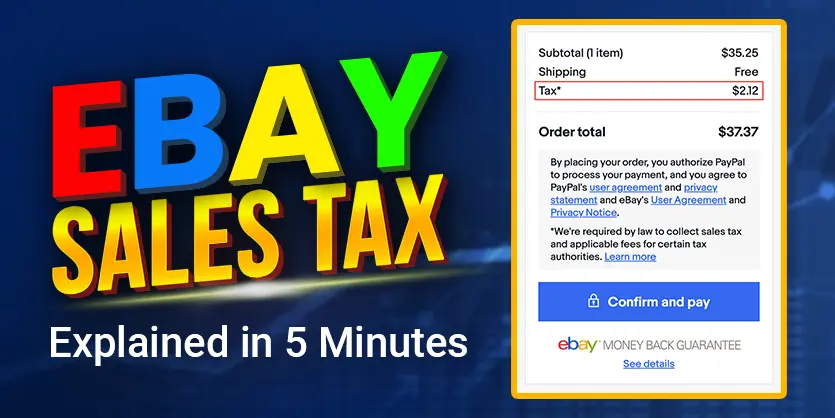

Sales Tax

Sales tax is another important aspect to consider. According to local laws and the buyer’s location, it applies to every item you sell. Here, the majority of the sellers became confused.

Sales tax rules can be different depending on where you are. Most states impose a sales tax on items sold. However, there are a few states that do not have a sales tax, including Alaska, Delaware, Montana, New Hampshire, and Oregon.

Since most Americans live in states that have a sales tax, so, most online sales will involve some form of tax law. As an online seller, it is your responsibility to collect and pay the appropriate sales tax for transactions within these states.

However, the complication is that each state has its own way of dealing with sales tax for online products. The sales tax policy differs from state to state. Some states impose taxes according to the item’s sale location, while other states base their taxes on the location of the buyer.

There is a change in 2018. That is, the requirement to collect and pay sales tax in a state does not require your physical presence there. Due to this change, online sellers do not require physical presence for their tax duties.

How eBay Makes Sales Tax Collection Easy for Sellers

eBay now automatically handles sales tax collection to make the process easier for sellers. This recent change significantly simplifies the tax process.

Previously, sellers were responsible for setting up their tax tables and figuring out the appropriate rates for each state. They also had to figure out whether taxes applied to shipping and handling fees. This process was complex and time-consuming for the sellers.

However, in 2018, the new law changed the entire process. From then on, online platforms like eBay are required to automatically calculate, collect, and submit sales tax.

For most states, eBay takes care of sales tax collection for you. But there are still a few states where you might need to handle it yourself. In this case, you must know the specific laws regarding sales tax in your local state.

Why Sellers Should Be Concerned About eBay Sales Tax

It is a great relief for sellers that eBay has automated the process. At the same time, it is a great concern. Because now you have less control over your cash flow.

Sales tax rates vary from state to state. It also differs based on specific groups, organizations, or types of items. Knowing these different tax policies would help sellers ensure proper tax collection and compliance with local laws.

If sellers do not collect the correct sales tax, they may be held liable for the tax amount, along with penalties and interest. This can impact the reputation of any business.

How Sellers Should Deal with Sales Tax

If you’re required to collect sales tax, you can set up a tax table and apply it to your eBay listings. Then eBay will automatically add the sales tax to the buyer’s total at checkout. Once you receive the payment, you’ll be responsible for transferring the collected sales tax to the appropriate tax authorities.

How to Setup a Tax Table on eBay

To set up a tax table, visit the Sales Tax Table Page. Enter the sales tax rate for each state where you need to charge sales tax. If you also need to tax shipping and handling in that state, select the “Also Sales Tax on Shipping and Handling” checkbox and then click “Save.”

How eBay Handles Sales Tax on Personal Items

In some states, certain items are exempt from sales tax. eBay operates as a marketplace facilitator, which means that in many regions, it is required to collect and remit sales tax on behalf of its sellers. For instance, textbooks are tax-exempt in Minnesota, and gold coins are exempt in Washington State.

Generally, personal or used items sold by individuals are also exempt from sales tax in most states. These sales are considered casual or occasional and typically do not meet the threshold for tax collection. This exemption helps simplify tax compliance for individual sellers.

Drawbacks of eBay Sales Tax

Although eBay’s automated sales tax system makes it easier for sellers to collect taxes, there are some disadvantages. One of the primary concerns is the lack of control sellers have over tax settings, as eBay automatically applies the tax rates. This can be problematic, especially when the system incorrectly applies sales tax to items that should be exempt.

Additionally, eBay does not currently offer a way for sellers to mark specific items as tax-exempt. eBay sellers are a little frustrated because they are unable to mark an item as tax-exempt at this time. We hope eBay addresses this issue in the future.

These issues highlight the need for ongoing attention to how eBay’s sales tax policies impact your business.

Conclusion

To conclude, understanding the complexities of sales tax on eBay is crucial for sellers to avoid potential mistakes. Sellers must still stay informed about specific state laws and ensure proper tax collection to avoid liabilities. While eBay’s automated system eases the burden, it also reduces sellers’ control over cash flow. So it is important to understand the different tax rates and exemptions.

If you’re looking to simplify your tax obligations and focus more on growing your business, we’re here to help. Our team of experts can handle the intricacies of eBay sales tax management, ensuring compliance and peace of mind. Feel free to let us know in the comment box or email us at the following email address: info@ecomclips.com

To learn more about eBay, please check out our other blog. Also, you can check out our YouTube videos related to eBay as well.