Before your Amazon dream becomes reality, you must know which products buyers hunt for.

If you’re launching a new product or scaling your brand, finding a niche with high demand and low competition is your golden ticket. When new sellers launch a product on Amazon, they often fail not because they pick the wrong product, but because they pick without data.

According to Amazon marketplace data, over 80% of failed launches share the same root cause – the seller assumed there was a market for the targeted product, without validating it with real data. That’s why mastering product research, keyword demand, and competitor analysis isn’t optional in 2025; it’s your competitive edge.

In 2025, the most successful sellers aren’t those who launch flashy products, but those who identify high-demand, low-competition niches with long-term growth potential.

In this guide, we’ll walk you through the exact steps to discover high-demand, low-competition niches on Amazon, so you can stop guessing and start building a business that actually sells.

Table of Contents:

- High-Demand, Low-Competition — The Real Meaning

- The Tools That Turn Data into Gold

- Spotting Hidden Niches: The Secret to Beating Competitors

- Competitor Deep Dive — Finding Gaps That Sell

- How to Pick Niches That Outperform the Crowd

- Profit First — How to Safeguard Your Amazon Investment

- Validating Demand Before You Invest

- Common Product Research Mistakes That Cost You Thousands

- The Ultimate Product Research Checklist

High-Demand, Low-Competition — The Real Meaning

Most of the successful Amazon sellers share a common language that is the language of data. Best sellers understand how to identify products with high demand and not flooded with competitors. However, select products according to fashion, hunch, or preference and in most cases they end up with items which are not selling well.

High demand means people are consistently searching for a product, buying it regularly, and showing stable interest month after month. You can measure this through Amazon search volume, keyword trends, and steady sales velocity.

Low competition, on the other hand, doesn’t mean “no sellers.” It means no dominant players — niches where top listings have fewer than 300 reviews, branding feels generic, or listings are outdated. These are the untapped corners of Amazon where a fresh, optimized product can quickly stand out and rank.

Smart sellers decode these signals early—then build listings that rank, convert, and outperform the competition. That’s where visibility meets opportunity.

The Tools That Turn Data into Gold

Top Amazon sellers rely on tools like Helium 10, Jungle Scout, DataDive, and SmartScout to analyze product demand, competition, and sales trends. To make smart product decisions, you need the right tools:

- Helium 10 – comprehensive keyword, product, and trend analysis

- Jungle Scout – sales estimates and competition insights

- DataDive/SmartScout – deep niche research and profitability data

- Keepa – Tracks historical price and sales rank data for products

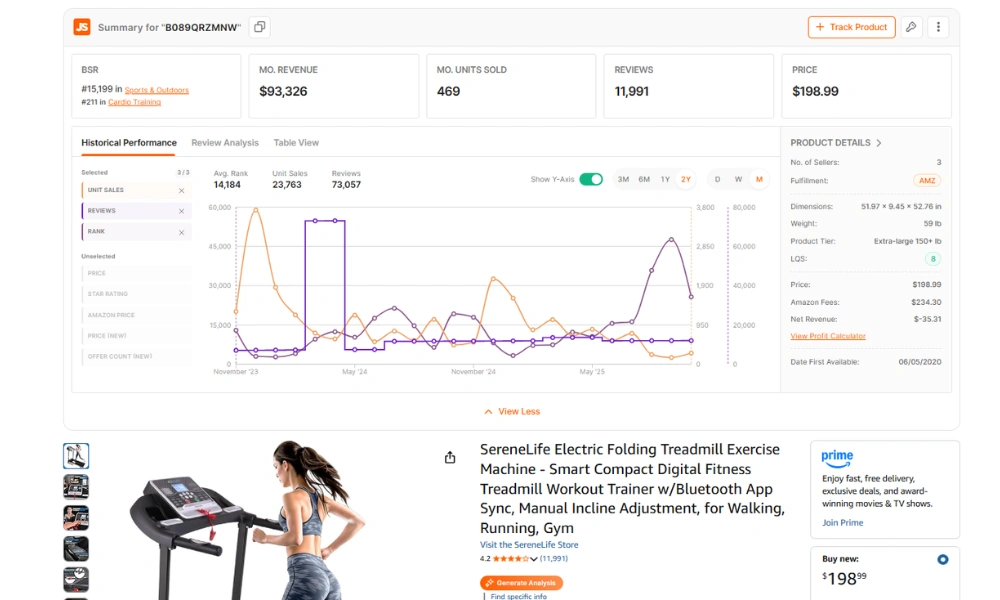

Tracking Sales, Rank, and Reviews with JungleScout

When researching a product, these tools help us identify products with high demand, low competition, and profitable margins. Focus on monthly search volume to gauge buyer interest, monitor Best Seller Rank (BSR) trends to track sales velocity, check the average selling price to ensure profitability, and analyze the review-to-sales ratio to evaluate competition and market opportunity.

Spotting Hidden Niches: The Secret to Beating Competitors

Hidden niches are all about finding demand where competition is low. The most profitable niches are often the ones that aren’t obvious, hidden opportunities that top sellers spot before the competition.

To identify these rising markets, start by analyzing keyword trends and best seller data using tools.

It’s also important to differentiate between seasonal and evergreen niches. Seasonal niches can generate huge short-term profits during peak periods, but evergreen products offer consistent, year-round sales and long-term stability.

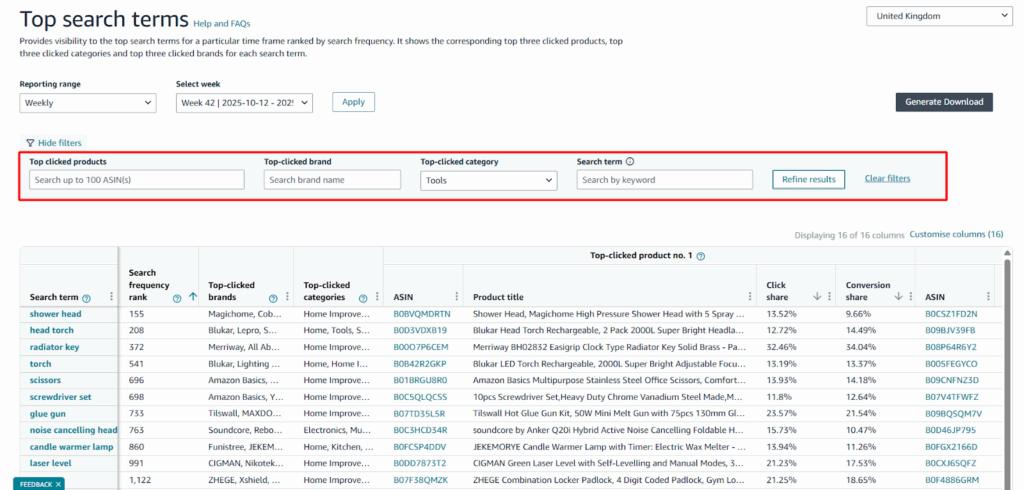

Amazon’s Brand Analytics and Search Query Performance tools provide additional insights into market growth. By tracking how often certain keywords are searched and how competitors perform, you can uncover underserved niches and predict rising demand.

Competitor Deep Dive — Finding Gaps That Sell

Understanding your right competitors is the first step to discovering profitable opportunities on Amazon. You can start by searching for your targeted product and analyzing the top-ranking keywords in that niche. The highly established brands with thousands of reviews usually indicate a saturated market.

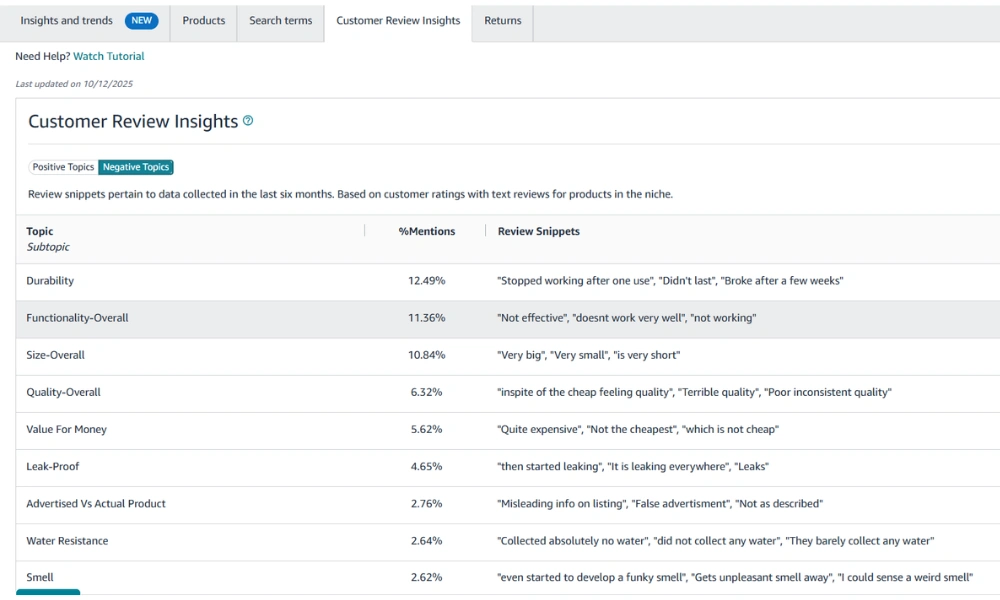

Next, check competitor listings for outdated images, missing A+ content, incomplete descriptions, or poorly answered customer questions. Use tools like Amazon Product Opportunity Explorer to uncover unmet demand and spot gaps in the market. These insights reveal opportunities to create a better, more compelling listing that can outperform the competition

Analyzing Negative Reviews with Amazon Product Opportunity Explorer

If 3 of the top 10 listings in your niche appear outdated or low-quality, you’ve likely found an opportunity to launch a product that stands out and captures market share.

Thinking About Hiring an Amazon Expert?

Ecomclips’ Partners Achieve an Average 85% Profit Increase!

How to Pick Niches That Outperform the Crowd

A winning niche isn’t just about what’s trending; it’s about finding where demand exceeds supply. Spot products that customers are searching for but not finding enough quality options.

Start by identifying markets where search volume is strong, but the competition (review count + seller presence) is still manageable. Tools like Helium 10, Jungle Scout can reveal keywords with steady traffic but fewer listings. Look for products with consistent BSR (Best Seller Rank) trends and under 300 reviews on top listings, a sweet spot that signals opportunity.

Tracking BSR with Helium 10

Once you’ve identified a promising niche, the next move is mastering the art of outperforming the competition.

How to Outperform Top Listings on Amazon:

Every best-selling product on Amazon has one thing in common, it perfectly aligns with what buyers want most. But outperforming those top listings isn’t about copying them, it’s about understanding their strengths, spotting their weaknesses, and strategically improving every detail. Here’s how you can do exactly that:

- Study Top 10 Listings Deeply: Analyze top sellers’ titles, bullet points, reviews, and A+ Content. Identify what buyers love — and what they complain about.

- Spot Review Gaps: Sort reviews by “critical” or “most recent.” Find repeated frustrations (e.g., packaging, quality, missing features) and fix those pain points in your version.

- Optimize for Keywords They Miss: Use tools like Helium 10’s Cerebro to uncover high-traffic keywords your competitors aren’t targeting in titles or bullets.

- Differentiate Visually: Upgrade your images. Add infographics, lifestyle shots, and comparison charts showing how your product solves more problems.

- Add Small but Meaningful Features: A better handle, premium material, bonus item, or improved packaging can instantly make your product stand out.

- Craft a Compelling Listing Story: Don’t just list features — connect emotionally. Highlight benefits and outcomes, not just specs.

- Use Smart PPC Validation: Run small, targeted ad campaigns to test which keywords convert best before scaling.

- Position with Branding, Not Just Pricing: Competing on price is a race to the bottom; competing with perceived value is a path to the top.

By combining smart niche research with competitor gap analysis, you can build listings that not only attract clicks but also convert better and rank faster. Winning niches aren’t luck—they’re the result of informed, data-driven decisions.

Profit First — How to Safeguard Your Amazon Investment

Before launching a product on Amazon, it’s crucial to confirm that it will actually be profitable. Start by accounting for Amazon fees, FBA costs, and shipping expenses, as these can significantly impact your bottom line. A good rule of thumb is to aim for a minimum profit margin of 30–40% before launching, ensuring your product can sustain your business even after all costs are covered.

Key cost considerations include:

- Amazon fees & FBA costs – referral fees, storage fees, and fulfillment charges.

- Production & sourcing costs – from verified suppliers or local manufacturers.

- Shipping & customs – international freight, duties, and last-mile delivery.

- Landed cost – the total cost of getting your product to Amazon, including shipping, customs, and duties.

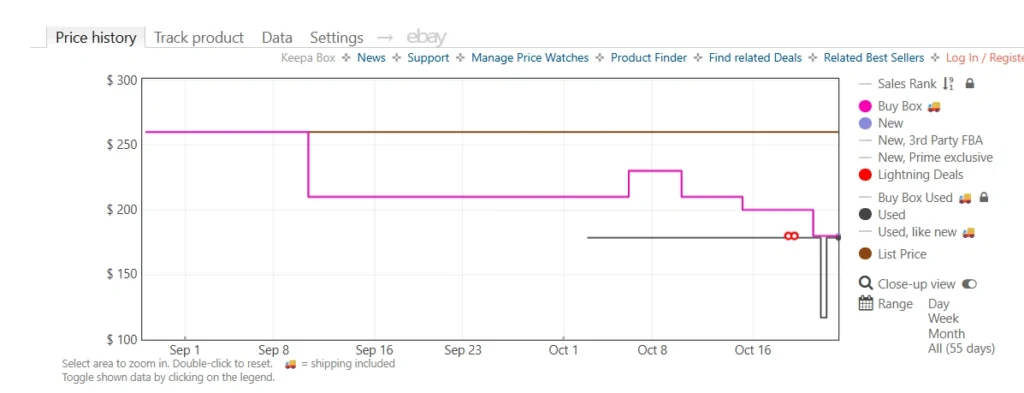

Once you have your total cost, compare it with your expected selling price to calculate the profit margin. Always track your competitors’ prices over time using price tracking tools to ensure your product remains competitive while maintaining healthy margins. This step helps anticipate market fluctuations and avoids surprises that could eat into profits.

Price Tracking with Keepa Tool

By combining accurate cost calculation with ongoing price monitoring, you ensure your niche and product are truly profitable before you invest heavily in inventory or marketing.

Validating Demand Before You Invest

It’s essential to validate demand to minimize risk and avoid costly mistakes. Start by analyzing keyword trends using Google Trends and Amazon data to see if interest in your product is rising, stable, or declining.

Keyword Trends on Amazon Brand Analytics

Next, test demand with a small batch of inventory. Launching a limited quantity can save thousands in potential losses by confirming whether there’s sufficient demand before scaling. You can also use Amazon PPC campaigns to further validate demand by testing how many customers click and convert for your product.

By validating demand early, you reduce risk, gain actionable insights, and ensure your product has a real shot at success before scaling.

Always validate with real sales data before scaling. Testing reduces risk and ensures your product has a viable market before you invest heavily.

Common Product Research Mistakes That Cost You Thousands

One of the biggest errors is choosing passion over data. Just because you love a product doesn’t mean buyers will—always validate demand with real metrics.

Another common misstep is ignoring review signals and brand saturation. If the top listings are dominated by established brands or products with thousands of reviews, entering that niche will be an uphill battle. Likewise, copying viral social media products without validating long-term demand can leave you stuck with dead inventory once the trend fades.

Skipping margin analysis is another silent killer. Many products that seem profitable on the surface lose money once you factor in Amazon fees, FBA costs, and shipping. Finally, overlooking compliance or category restrictions can result in listing removals or account issues—turning your investment into a loss overnight.

Common Mistakes to Avoid:

- Picking passion over proof: choosing what you like instead of what the market wants.

- Ignoring competition: missing signals like high review counts or brand dominance.

- Chasing trends blindly: copying viral products without checking long-term demand.

- Skipping margin math: forgetting Amazon fees, FBA, and shipping costs.

- Overlooking restrictions: launching in gated or compliance-heavy categories.

Always cross-check your product ideas through three sources of data, demand, competition, and profitability, before sourcing or launching.

The Ultimate Product Research Checklist

Before finalizing any product, run it through this quick checklist to make sure it’s truly worth launching. Think of it as your final filter before investing time, money, and effort:

- Confirm Steady Buyer Interest: Check Amazon search data and use keyword tools like Helium 10 or Jungle Scout to ensure consistent demand.

- Target Low-Competition Niches: Focus on categories where top listings have fewer than 300 reviews, giving you a better chance to rank and grow.

- Ensure Healthy Profit Margins: Aim for at least a 30% profit margin after deducting all Amazon fees, shipping, and sourcing costs.

- Avoid Gated or Restricted Categories: Verify that your product isn’t in a category requiring special approval to prevent delays or rejections.

- Stand Out from Competitors: Make sure your product differentiates itself through design, packaging, unique features, or branding that sets it apart.

In 2025, the top Amazon sellers aren’t those who chase trends, they’re the ones who study patterns, analyze data, and make decisions backed by research. True success comes from understanding product demand, assessing competition, and validating every product idea before investing.

By using the right tools, conducting thorough research, and testing your ideas, you can turn guesswork into a strategic approach. Every insight you gather brings you closer to a product that sells consistently and scales profitably.

Frequently Asked Questions

Q1: What is the best way to find high-demand products?

The best approach is to use Amazon keyword and product research tools like Helium 10 or Jungle Scout. These help you identify products that have steady search volume and consistent sales over time, indicating genuine demand.

Q2: How can I measure competition accurately?

To gauge competition, analyze the number of active listings, the review counts of top products, and the diversity of brands on the first page of search results. This shows how crowded the market is and whether there’s room for a new seller.

Q3: How much data do I need before deciding?

You should track at least 2–3 months of sales data and Best Seller Rank (BSR) trends. This helps ensure that the product has consistent, real demand rather than a temporary spike.

Q4: Are there still untapped niches on Amazon in 2025?

Yes. Micro-niches and very specific product variations are growing rapidly. By finding unique solutions to customer problems or unmet needs, sellers can enter markets with low competition and strong profit potential.

Q5: What’s better — high-demand or low-competition?

The key is balance. A product with moderate demand and low competition often performs better than a high-demand, oversaturated market because it’s easier to rank, convert, and scale profitably.

How Ecomclips Helps You Find Winning Amazon Products

At Ecomclips, we don’t rely on luck, we rely on data. Our team uses advanced research tools, historical sales data, and AI-backed analysis to uncover high-demand, low-competition products that actually sell.

- Comprehensive Market Research: We dive deep into category trends, keyword opportunities, and price patterns to identify niches with strong demand and low saturation.

- Competitor & Keyword Analysis: Our experts analyze top-performing listings, customer reviews, and keyword gaps to position your products exactly where shoppers are searching.

- Profitability & Sourcing Validation: We calculate FBA fees, logistics costs, and profit margins to ensure your chosen product isn’t just popular — it’s profitable.

- Listing Optimization & Launch Strategy: Once a winning product is found, our Amazon optimization service builds keyword-rich titles, A+ content, and high-converting visuals that help you dominate your category.

- Performance Tracking & Continuous Growth: Ecomclips monitors performance data, reviews, and competitor movement — refining your strategy to keep your brand ahead of market trends.

When you partner with Ecomclips, product research becomes more than guesswork, it becomes a repeatable, data-driven process for scaling your Amazon business toward 7-figure success.

Contact us at info@ecomclips.com or book a consultation to discover your next winning product.

Watch how we help Amazon sellers identify profitable niches →

Amazon Sellers: Steal 30% of Competitor Sales with This Hack

How to Use Amazon Product Opportunity Explorer for Product Development

How I Ranked a Brand-New Amazon Product on Page 1 (Without Reviews!)

How REAL USA Brands Grow to 7 Figures on Amazon (Truth No One Tells You)

Amazon SEO in 2025 | Fix Your Amazon Ranking Fast

Ecomclips: Your Complete eCommerce Solution Under One Umbrella

At Ecomclips, we bring every eCommerce service you need under one roof — strategy, operations, design, marketing, and growth, all seamlessly connected to help your brand thrive across every marketplace.

Since 2012, we’ve been helping businesses of all sizes launch, scale, and dominate online. From Amazon, Walmart, eBay, and Etsy to Shopify and WooCommerce, our team of marketplace experts, designers, developers, and marketers works together to deliver measurable results.

Our services span the full eCommerce lifecycle:

- Account Setup & Product Listing Management: We handle registrations, compliance, and product data optimization across all marketplaces.

- Amazon Optimization Service: From keyword-rich titles and A+ content to PPC campaigns and storefront design, we craft listings that convert.

- Creative Design & Content Production: A+ visuals, infographics, brand stores, and product videos built to boost engagement.

- Advertising & PPC Management: Smart, data-driven ad strategies for Amazon, Walmart, and Google that maximize ROI.

- Web Development & Store Design: Shopify, WooCommerce, and Magento websites built for performance and conversion.

- Data Management & Automation: Streamlined product feeds, catalog syncing, and inventory control for effortless scalability.

- Customer Service & Order Fulfillment: End-to-end support that enhances customer satisfaction and builds long-term loyalty.

- Analytics & Growth Strategy: Real-time insights and ongoing optimization to ensure consistent, profitable growth.

Whether you’re launching a new store or managing multiple global marketplaces, Ecomclips acts as your single strategic partner, simplifying complexity and driving sustainable revenue growth.

Ready to Start Growing Your Brand?

Ecomclips’ Partners Achieve an Average 85% Profit Increase!