Introduction

Amazon has made a shocking move by suddenly pulling all its ads from Google Shopping worldwide. This unexpected exit has left many sellers, advertisers, and industry experts wondering about the reasons behind it and the ripple effects it might create. Usually, Amazon is known for being calculated and strategic in its advertising efforts, making this overnight pullout even more unusual. For smaller brands, however, this sudden change could actually be a blessing in disguise. Lower competition on Google Shopping ads means reduced cost-per-click (CPC), opening new opportunities to reach customers at a lower cost. Let’s break down what really happened, why it matters, and how businesses can take advantage of this shift.

Amazon’s Sudden Exit from Google Shopping

It’s not often that a giant like Amazon makes abrupt moves in the advertising world. Yet, within just two days, Amazon dropped from dominating Google Shopping ad impressions in countries like the USA, UK, and Germany to completely disappearing.

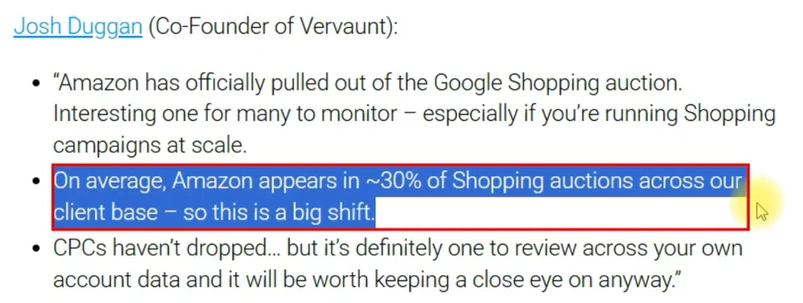

Industry experts were quick to point out how unusual this was:

“I haven’t seen Amazon pull back from ads this sharply since the peak of the pandemic lockdowns.”

During that time, advertisers noticed a 20% drop in CPC, which made ads more affordable. The same pattern could repeat again, giving smaller sellers a window to jump in while the competition is low.

Key Notes:

- Amazon’s ad share on Google Shopping dropped to zero within 48 hours.

- This is different from seasonal fluctuations; it’s a complete pullout.

- Advertisers should expect cheaper CPCs and higher visibility for now.

Thinking About Hiring an Amazon Expert?

Ecomclips’ Partners Achieve an Average 85% Profit Increase!

Why Did Amazon Pull Ads? Possible Explanations

Whenever a big company like Amazon changes course, there’s always a strategy behind it. But in this case, the exact reasons remain unclear. Analysts and marketers have shared different theories:

- Prime Day Pause: Some believe it could be a short-term break after Amazon’s biggest sales event. However, experts note that a complete halt is unusual, even post-Prime Day.

- Budget Reset: Amazon might have simply maxed out its monthly ad budget and chosen to pause campaigns temporarily.

- Ad Strategy Shift: With 63% of online product searches already starting on Amazon, they may no longer see as much value in paying Google for visibility.

- CPC Negotiation or Contract Reset: There could be ongoing talks between Amazon and Google behind the scenes.

“Amazon usually plays the long game. An overnight exit signals either a bigger negotiation or a calculated test.”

What This Means for Smaller Sellers

For sellers and DTC brands, Amazon’s sudden disappearance creates a rare opportunity. With fewer big players competing for ad space, Google Shopping ads may become:

- Cheaper → Lower CPC, meaning more clicks for less budget.

- More Visible → Smaller brands can now capture impressions Amazon previously dominated.

- Strategic → A great time to test campaigns before Amazon returns.

If you’ve been considering investing in Google Shopping Ads, this could be the perfect time. Acting fast allows you to capitalize before other brands rush in.

Tip:

Keep monitoring CPC trends over the next few weeks. If the costs remain low, increase your ad spend strategically.

Historical Context: Has Amazon Done This Before?

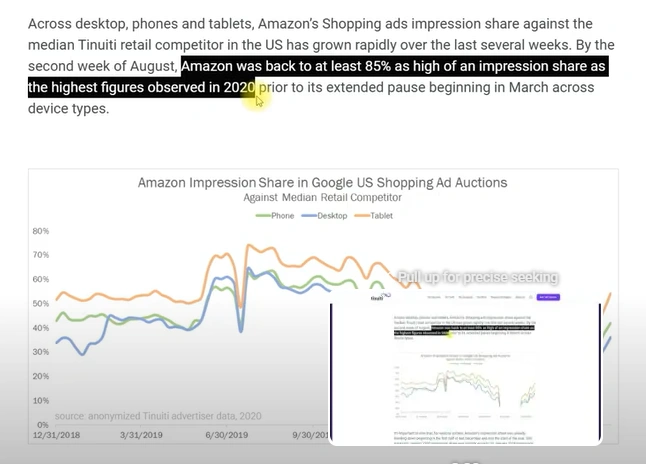

This isn’t the first time Amazon has paused its presence on Google Shopping. During the early pandemic period, they pulled back on ads, expecting reduced demand. Surprisingly, demand soared, and Amazon still came out ahead.

This time, however, the situation feels different. Amazon’s retreat comes right after their biggest sales day of the year (Prime Day). Instead of focusing on demand management, this move could indicate deeper strategic changes.

Note: If history repeats itself, Amazon may return soon. But in the meantime, other sellers get a rare head start.

Action Plan for Sellers: What Should You Do Now?

Amazon’s sudden withdrawal from Google Shopping has created a short-term opportunity that smaller brands rarely get. With lower CPCs (Cost Per Click) and less competition for impressions, you can gain visibility at a fraction of the usual cost. But to maximize this golden window, you need a clear action plan. Here’s how:

1. Test Google Shopping Ads While CPC Is Lower

Right now, the competition gap is wide open. Amazon typically holds up to 80% of shopping ad impression share in the USA, which means thousands of auctions just got freed up. By running Shopping Ads now, you can win placements that would normally cost far more. Even if you’ve never tried Google Shopping before, this is the best moment to launch test campaigns and gather data.

2. Increase Budgets Gradually

Don’t dump your entire ad budget into Google overnight. Start small, analyze early results, and then scale strategically. For example, begin with $20–$50 per day to test campaigns, then gradually increase your budget once you see which products or keywords deliver the best ROI. This ensures you capture impression share efficiently without wasting spend.

3. Track ROI Carefully and Scale Winners

With CPCs potentially dropping by 10–20% (based on similar patterns in 2020), ROI can improve significantly. But it only matters if you measure correctly. Monitor:

- Conversion Rate (CVR)

- Average CPC

- Return on Ad Spend (ROAS)

- Cost per Acquisition (CPA)

Scale campaigns that generate profit while pausing those that drain resources. Remember, this window may be temporary, so focus on what works fast.

4. Leverage Cross-Platform Ads

Amazon’s retreat doesn’t just affect Google Shopping — it opens the door for brands to dominate the customer journey across multiple platforms. By combining Google Ads with Meta (Facebook/Instagram) and TikTok campaigns, you can retarget shoppers who search, scroll, and engage on different platforms. This full-funnel approach builds stronger brand visibility while maximizing conversions.

5. Prepare for Amazon’s Return

Amazon’s absence might be short-lived. They could come back stronger in a matter of weeks with aggressive bidding. That’s why it’s crucial to build momentum now. Use this time to gather data, refine your campaigns, and grow your visibility so that when Amazon returns, your campaigns are already well-optimized and competitive. Think of it as securing your spot before the giant re-enters the arena.

In short: Treat this as a once-in-a-year window. Get in early, move smartly, and focus on ROI. If Amazon returns quickly, you’ll still have built valuable ad data and brand exposure. If they stay out longer, you’ll be positioned to dominate at a lower cost.

FAQ Section

Q1. Why did Amazon stop Google Shopping ads?

Amazon hasn’t given an official reason. Experts suggest it could be a budget reset, contract renegotiation, or a post-Prime Day pause. It might also signal a shift in focus toward Amazon’s own ad ecosystem.

Q2. Will Amazon return to Google Shopping ads?

Most likely yes. Amazon has paused ads before and returned stronger. However, this break creates a short-term window for smaller sellers to benefit.

Q3. How does this affect smaller sellers?

With Amazon out, CPC costs drop and ad space opens up. Smaller brands can now advertise more cheaply and gain visibility that was previously dominated by Amazon.

Q4. Should I invest in Google Shopping Ads right now?

Yes, if you have the budget. This is the best time to test because you’ll likely see higher impressions and lower CPCs than usual.

Q5. What if Amazon never comes back?

Unlikely, but if that happens, sellers who act now will already have built strong ad foundations and brand visibility.

Final Thoughts

Amazon’s sudden exit from Google Shopping has left a big gap in the marketplace. While the reasons remain unclear, what’s certain is the huge opportunity this creates for smaller brands. If you’re selling online, now is the time to act, test, and scale. CPC is down, visibility is up, and your competitors may not yet be taking advantage.

At Ecomclips, we help sellers like you navigate major shifts, optimize ads, and grow brands profitably. With over a decade of experience in Amazon, Walmart, and Google advertising, we know how to turn challenges into opportunities.👉 Ready to grow smarter while Amazon steps back?

📩 Contact us at info@ecomclips.com and let’s build your ad strategy together.

Ready to Start Growing Your Brand?

Ecomclips’ Partners Achieve an Average 85% Profit Increase!